Job Market Paper

Beating the Index with ETFs

Link

ABSTRACT

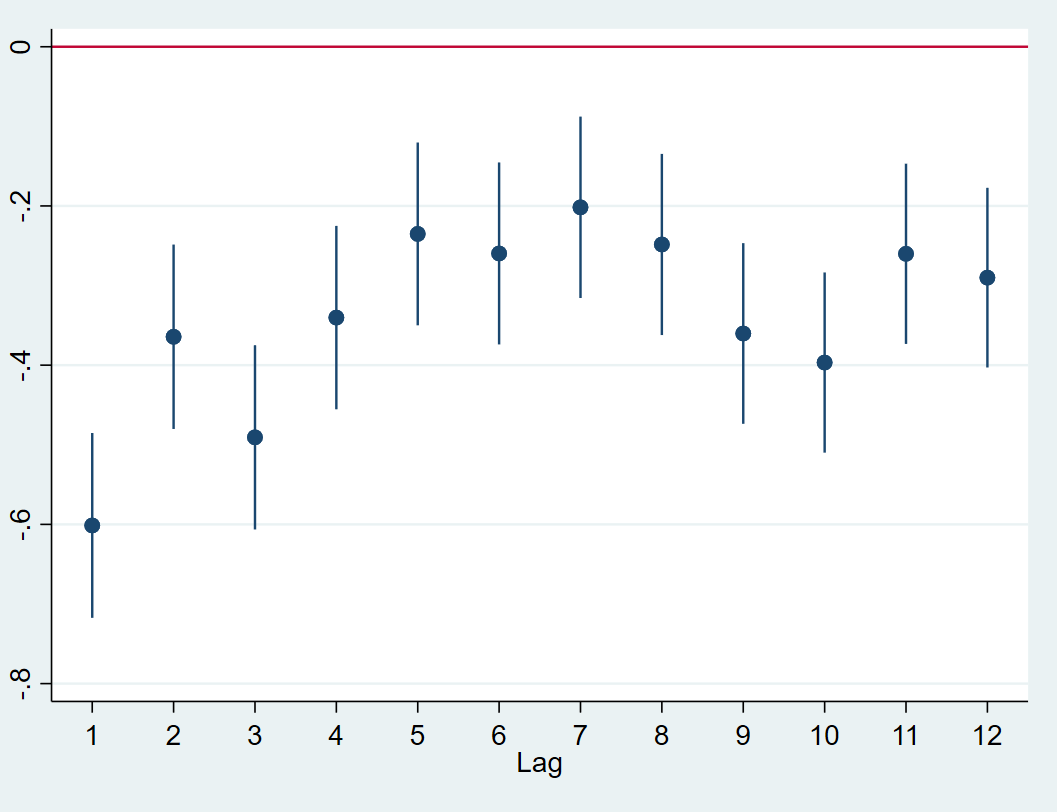

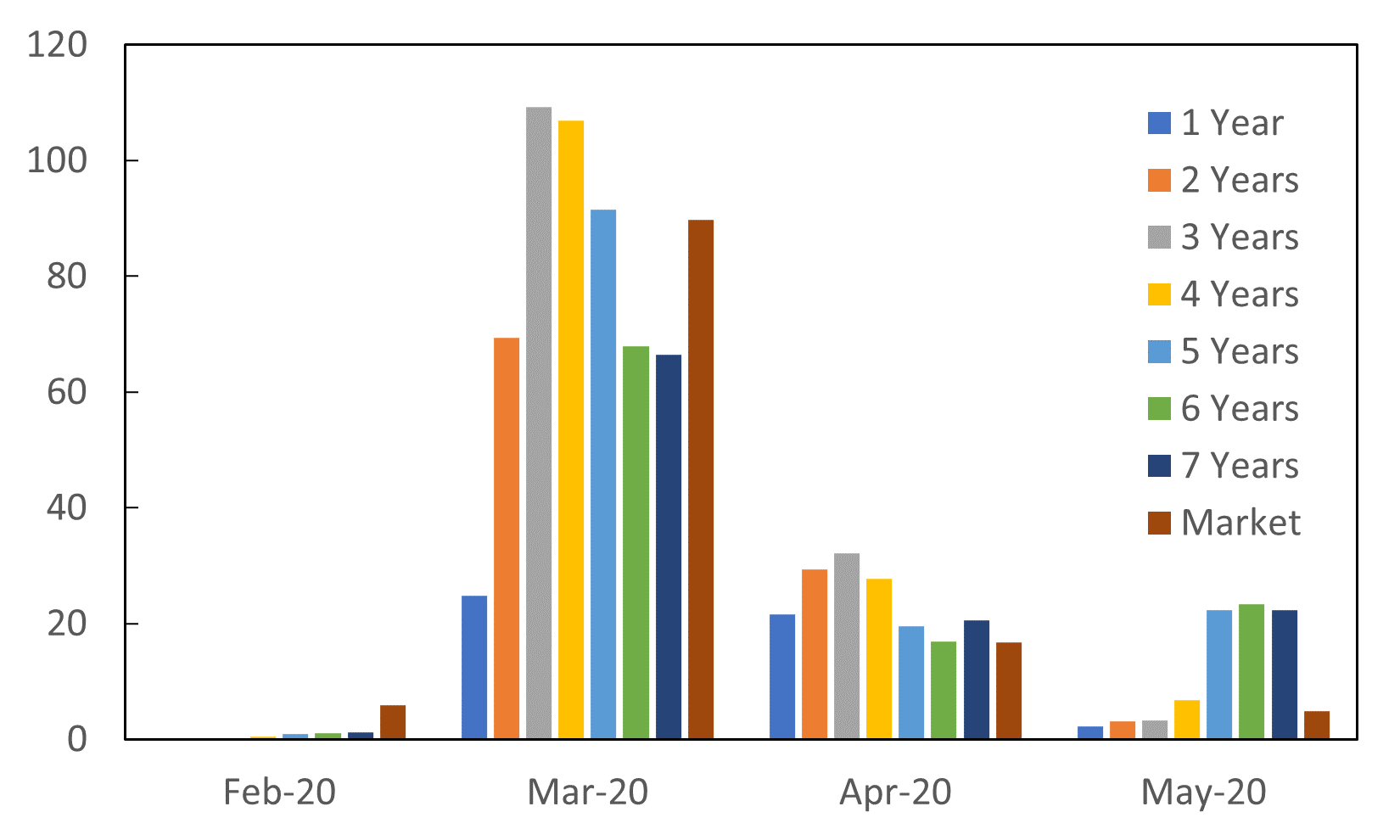

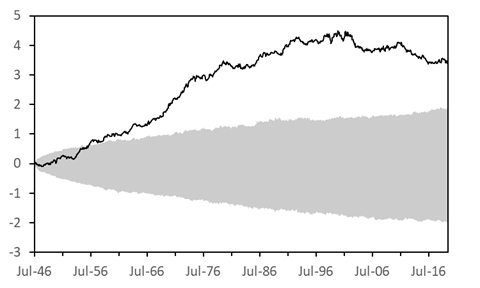

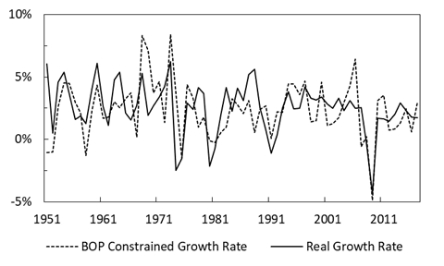

ETFs have been well-known for tax efficiency. With in-kind redemption, ETFs distribute almost no capital gain to investors, allowing them to track indices closely after tax. On top of the existing knowledge, this paper finds evidence that highly correlated ETFs are used to harvest capital loss without triggering the wash-sale rule. The average monthly tax-loss trading volume is 9.1% of the asset under management, representing 20.7% of total trading volume. Tax-loss harvesting is negatively associated with past returns and positively associated with realised volatility. The connection is more substantial for recent and negative returns. ETFs with larger sizes and bid-ask spreads have lower tax-loss trading volumes relative to their assets under management. This paper builds a parsimonious model to explain the connection between tax-loss harvesting and past price movements.